What We Offer

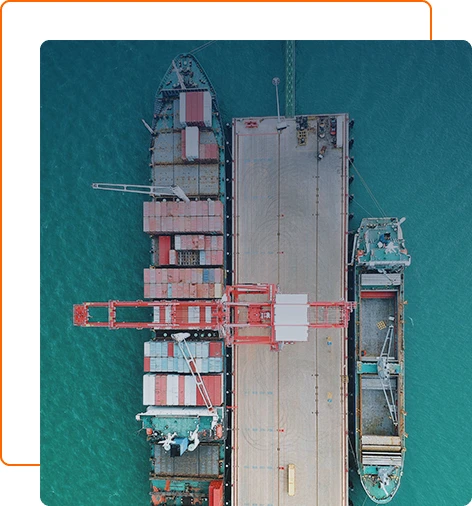

Fast and Compliant China Customs Solutions

We simplify China import customs clearance with accurate documentation, tariff guidance, and full compliance — minimizing delays and extra costs.

Documentation

All paperwork, licenses, and certificates are handled precisely to ensure smooth customs entry.

On-Time Delivery

Our experienced team ensures clearance is completed quickly and shipments stay on schedule.

Why Choose Us

Hassle-Free China Import Customs Clearance

Documentation Preparation

We gather and prepare all the necessary customs documents, ensuring compliance with Chinese import regulations.

Submit to Customs

We submit all the required documents to Chinese customs authorities for review and approval.

Clearance Approval

Our team ensures that customs clearance is approved without delay, minimizing any potential bottlenecks.

Delivery

Once cleared, we arrange for the prompt delivery of your goods to your location, ensuring smooth logistics.

Trade Q&A

China Import Customs Clearance FAQs

Get professional support for clearing imports through Chinese customs. We simplify the paperwork, regulations, and timelines to make the process hassle-free.

Fast Solutions

Receive clear, practical answers to keep your business moving without delays.

Expert Guidance

Connect with professional agents who understand every step of global trade.

Looking to find an agent to import raw steel and inquiring about the customs duty. Concerned that duties may vary due to different types of steel and import regions, and hoping to prepare a cost budget in advance. The best answer states that raw steel import duties vary depending on the specific type of steel and the country of origin. Common ordinary carbon structural steel and alloy steel have different tax rates. Imports from specific treaty countries may enjoy zero tariffs. It is necessary to clarify the type and country of origin to consult the tariff schedule or a professional company for precise tax rates.

Planning to engage in the business of customs clearance agency for cheese imports, but lacking experience and unsure where to start, asking for specific methods. The best answer suggests first obtaining qualifications such as import and export rights, obtaining documents before the goods arrive at the port, and reviewing Chinese labels. After arrival, declare and pay taxes promptly, and cooperate with inspections and testing. Additionally, it is important to be familiar with regulations and policies, and focus on communication to ensure a smooth customs clearance process.

Planning to find an agent for import customs declaration in Zhongshan and want to understand the declaration elements. The best answer states that declaration elements include basic cargo information such as name, specifications and model; composition and material; purpose; and for special goods, also country of origin, packaging form, etc. The accuracy of these elements affects customs clearance efficiency and compliance, and needs to be clearly confirmed with the agent.

I want to work as an import customs clearance agent and am not sure what is needed. The best answer points out that professional knowledge is required, including familiarity with customs code classification and regulations; qualification certificates, such as the Enterprise Registration Certificate for Customs Brokerage Enterprises; good communication and coordination skills; and rich practical experience. These conditions are crucial for carrying out import customs clearance agent business.