Our Services

From China to You with Easy Import Solutions

About Us

20+

Years Trade Experience

Professional & Trusted

China Import Agency

Experts

Where efficiency meets reliability in global trade solutions. Founded in 2010, Zhongmaoda has been dedicated to simplifying imports from China for overseas clients, covering sourcing, customs clearance, and logistics.

10K

Successful Projects

150+

Nationwide Business

Case Studies

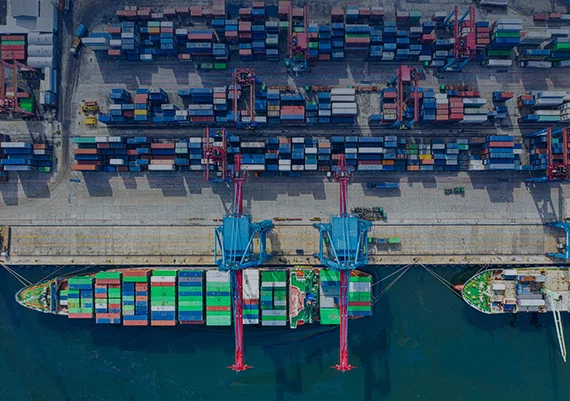

From China To

Global Markets

Plans & Pricing

Find the Right Plan for You

Custom

Single Solution

Tailored solutions for your unique import/export needs.

Targeted 1688 Sourcing

Pre-Shipment Inspections

On-Site Factory Audits

Market Sourcing & Research

International Logistics

Secure Payment Support

Warehouse Prep & Handling

Door-to-Door Delivery

Product Dev

5~10%

Assistance in sourcing and developing your products efficiently.

Product Development Support

Sourcing & Supplier Verification

Private Label & Customization

Production Oversight

Product Photography Included

Quality Inspection

Warehouse Storage

Door-to-Door Shipping

Supply Chain

Start from 4%

Manage sourcing, logistics, and inventory seamlessly.

Supplier Liaison & Management

Secure Payment Support

Inbound Goods Verification

Inventory Check & Preparation

Shipment Consolidation

Export/Import Documentation

Shipping Coordination

Customs Clearance Support

Expert Answers

Your Import & Export Q&A Hub

Get instant answers to all your international trade questions — fast, reliable, and expert-backed, helping you navigate global business with confidence and success.

Fast Solutions

Receive clear, practical answers to keep your business moving without delays.

Expert Guidance

Connect with professional agents who understand every step of global trade.

Interested in import home appliance agency but lacking experience, asking how to proceed from preliminary preparation to market promotion. The best answer suggests first conducting market research, finding reliable suppliers through various channels like "Zhongmaoda", and completing agent qualifications and import procedures. Promotion can combine online and offline methods, while establishing a comprehensive after-sales service system. All links are closely connected, jointly supporting the agency business.

The company intends to expand its overseas business, with products covering traditional manufacturing and emerging electronic products, and is asking which type of export agent is easier to work with. The best answer suggests choosing a general trade export agent, as its model is mature, policies and regulations are well-established, related supporting services are mature, and there are clear standards for foreign exchange settlement and tax refund processes, allowing for the use of professional agencies. Cross-border e-commerce export agent platforms, however, have complex rules and are less suitable for initial expansion.

Considering venturing into import and export agency business, I want to understand its pros and cons. Doubts are raised about complex business processes, fierce competition, and profit margins. The best answer states that whether it is easy or not depends on multiple factors. Although trade growth brings opportunities, there are challenges in customs declaration, logistics, and foreign exchange settlement, and competition is fierce. Success requires professional knowledge, resources, and services.

Companies with export business involving tax rebates want to understand what kind of unit an export tax rebate agency is and whether they are reliable, as well as points to consider when choosing one. The best answer points out that export tax rebate agencies are professional service units with professional teams to assist companies in handling tax rebates. When choosing, one should check professional qualifications, understand industry reputation, and evaluate the professionalism of the team.